The non-banking financial companies gained immense prominence very quickly in the last few years. Their downfall was even quicker. This study encompasses a complete analysis of all the reasons for the sudden crisis in the NBFCs. It also explains how this crisis affected the Indian economy, analyses the policy actions to rectify the crisis and, in the end, gives some policy suggestions that might help the situation.

INTRODUCTION-

NBFCs i.e. non-banking financial companies are companies registered under the Companies Act, 1956 engaged in the business of loans and advances, acquisition of shares, stocks, bonds, debentures and securities issued by Government or any other local authority.

These are the institutions that do not have full banking license They perform almost all the services provided by banks except accepting demand deposits of any kind from the public. NBFC cannot issue a cheque drawn on itself. Some of the top NBFCs of India are- Power Finance Corporation limited, Infrastructure Leasing & Financial Services, Shriram transport finance company limited, Bajaj finance limited, etc. NBFCs are regulated in India by various regulators like RBI, NHB (for HFC), IRDA (for Insurance) etc. as per the line of activity.

What was the NBFC crisis?

After the Lehman brother crisis, the government asked the banks to provide loans to infrastructure companies to boost the economy. However, the banks weren’t sure if doing so was the right thing and hence backed out. The NBFCs then stepped up and extended loans to these firms. NBFCs normally raise funds from banks, through long term debts, short term instruments like commercial paper, medium to long term NCDs subscribed by public, banks or mutual funds. If NBFC borrows on short term basis to finance long Term projects like infrastructure projects, housing projects etc., it will lead to an asset liability mismatch (ALM) and hence create solvency issues. NBFC in order to keep running in such situation keeps on rolling the short term borrowings. As soon as this circle breaks crisis take place.

The banks, which were apprehensive about lending to these firms on the first hand got indirectly related to real estate, construction, etc. i.e. all the high risk areas of the economy by subscribing to debt instruments/commercial paper floated by these NBFCs. The bulk of IL&FS paper is held by banks, insurers, provident funds and pension funds; mutual funds holding only 5 percent of the paper.

Everything went downhill when these loans given to the firms got held up because of various reasons. The IL&FS crisis is a good example of the firm which couldn’t repay the loans. It took short term borrowings to pay for the long term borrowings and couldn’t repay any of the loans hence falling in the debt trap. It experiences a debt of 91,000 cr. This led to the creation of a real estate bubble in the Indian economy.

IL&FS debacle has served to underline the high business risks inherent in NBFC business models that rely on short-term market borrowings for long-term loans. The resulting risk aversion by lenders has landed NBFCs and HFCs with high asset-liability mismatches in hot water (Reliance ADAG firms and DHFL, for instance).

On a whole, trillions of money is trapped in the construction, real estate and infrastructure sector. In addition to already having the problem of liquidity crunch, the banks have been hesitant to give NBFCs any further assistance in the form of loans. This has slimmed down the solutions for the NBFCs to come out their liquidity and solvency problems.

This problem is not just affecting the NBFC sector but the entire economy because the NBFCs are diversified.

Connecting the crisis to the Indian economy-

The consumer demand will be affected as in the recent years the NBFCs had started lending to the retail industry. The consumer demand in turn is a component of aggregate demand which will take a hit because of a decrease in consumption demand. The aggregate demand will in turn affect the output and employment of the country.

The companies now have to take loans from the banks, which are apprehensive about giving loans to any companies with a risky future, at high borrowing rates. This affected the investment demand for money.

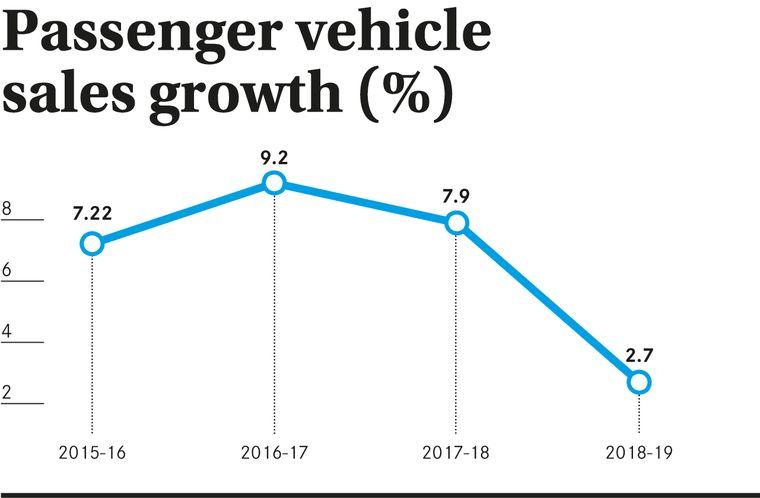

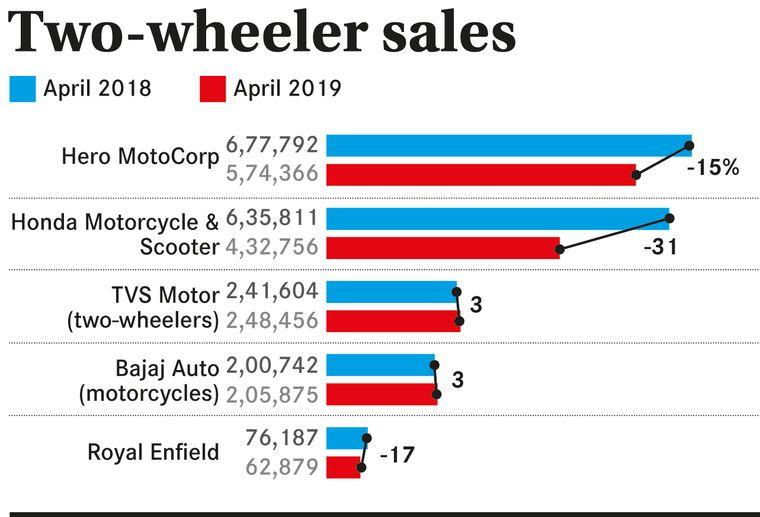

The crisis has already impacted the consumption and if the situation worsens, India will be on the route to economic downturn. Because of the IL&FS crisis, the banks have increased their lending rates to the NBFCs by about 1.5%. The NBFCs have in turn increased their lending rates. A decreased flow of car and personal loans can be seen by the fall of car and two wheeler sales to an eight-year low (Figures 1 and 2 ). If the scenario persists, the crisis will consume other sectors such as consumer electronics as well. This will prove to be fatal for the Indian economic growth. (moharkan, 2019)

Figure 1

Figure 2

Suggestions/Issues raised by NBFC Body (Literature Review)

Finance Industry Development Council (FIDC), the industry body for non-banking financial companies (NBFCs), sees the current liquidity crisis not a solvency issue, but more of a growth-related problem.

“As a short-term measure, there is an immediate need for the regulator to put in place and create a dedicated window for NBFCs. We are not asking for any bailout. This was done in 2009 and 2013. What we are saying is a message from the regulator or government would really do the trick,” said Raman Aggarwal, chairman, Finance Industry Development Council.

Another short term measure sought is allowing refinance for all small and medium NBFCs from the Pradhan Mantri Mudra Yojana.

Even government has requested the Reserve Bank of India to provide a window for NBFCs to keep the economy growing, but RBI has declined it saying system-wide liquidity is in surplus and it remains committed to infusing liquidity when required.

FIDC has called for a permanent window for NBFCs along the lines of the National Housing Bank, which provided refinance to housing finance companies (HFCs). It also sought setting up an alternative investment fund (AIF) to channelize institutional funds to NBFCs and allowing non-convertible debentures (NCDs) to be subscribed to by the AIF for onward lending to NBFCs. (Gopakumar, 2019)

Statistical evidence-

Through graph-3 and graph-4, we see that the NBFCs were doing well and growing in the lending sector and had actually managed to outrun the banks in the same. In Financial Year 2016-17, the NBFC sector was at its peak of success. At that time, the NBFC sector was being applauded for taking risks, which had a positive effect on the GDP of the economy. After the ILFS crisis, the same NBFCs are being criticised for taking undue risks to achieve high growth & margins.

Figure 3

Figure 4

However, because of the default in payment by some companies, the NBFCs started facing liquidity crunch and hence did not have enough funds for extending loans to commercial sector companies. This decline in the year 2017-18 can be easily seen in the graph.

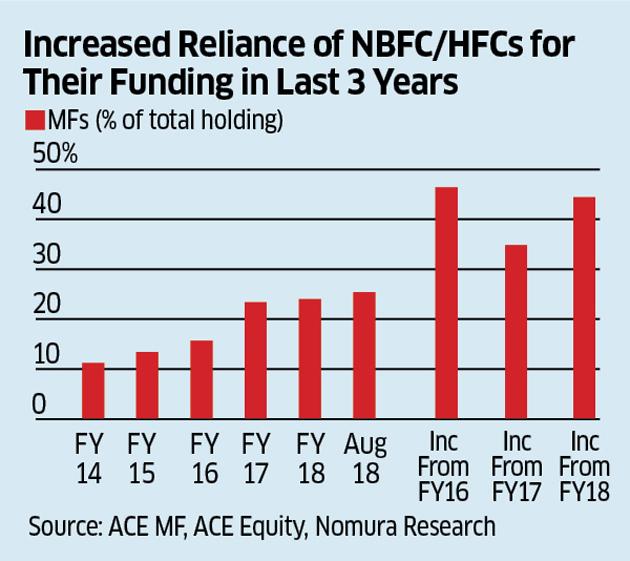

Graph 5 shows the

increasing reliance of the NBFCs and HFCs for gathering funds over the past 3

years. Because of the defaults of a few companies in paying their loans, the

NBFCs have not been able to raise enough funds to continue working.

Figure 5

Factors responsible for the crisis-

- Inadequacy of credit appraisal and credit monitoring

- Asset liability mismatch- The entire concept of NBFCs is a little risky as they take short term loans from banks and other sources to further lend for long term project.

- Lack of monitoring from the RBI-

Banks and NBFCs perform almost the same functions. Yet NBFCs are much less regulated than banks. They are not stopped from entering into transactions with very risky clients unlike the banks which are always under close supervision of the RBI.

Problems created by the NBFC sector-

- Liquidity crunch-Because of the default of the companies in paying their loan back, there is not enough money circulation in the economy i.e. a liquidity crunch has been created in the economy.

- The actual problem was of solvency. Everywhere it has been mentioned that the crisis called a major liquidity crunch. However, solvency was also a major issue. The ‘crux’ of the problem was the asset- liability imbalance. (“finance”, 2019)

- The small and medium sized NBFCs are particularly in a lot of trouble as banks are there major source of growing funds.

- Auto sales, two-wheelers and SMF have taken a hit because of liquidity squeeze in the past 6-8 months.

- The consumption demand in the economy will suffer. Due to the low investment demand and dwindling export demand, consumption demand was the only thing driving the economy.(“All you want to know about the NBFC crisis”, 2019)

Analysing the current policy actions-

- The ALM and liquidity crisis are restricted to a handful of NBFCs &. need closer regulatory supervision. Those accepting public deposits or retail NCDs require special attention.

- The regulators need to undertake special audits of the accounting policies of NBFCs to build up market confidence in the sector

- Ineffectual supervision by the RBI and NHB has left the doors open for the IL&FS and others to play out. Therefore regulators need to more closely monitor the statutory filings by NBFCs.

Policy suggestions-

- Reserve bank surveillance as well market surveillance will prove to be beneficial for the regulation of the NBFC sector.

- The RBI had committees in working. However, many of their policy suggestions remained on paper. An efficient committee which will look after the implementation of the approved policies in real life would help accelerate the process of normalisation of the situation.

- The NBFCs should be asked to keep some portion of the loan with them and not lend all of it. This is something similar to the concept of banks keeping LCR (liquidity coverage ratio). This would avoid the NBFCs from completely running out of funds in case if default in payment from any company to which the NBFC has lent.

- The most concerning problem right now is that despite the expenditures made by the government to rectify the situation, the lending rates remain high. Unless and until this problem is dealt with, the infrastructure and real estate sector won’t be able to come out of the loss.

Conclusion-

The problem is quite severe and demands immediate attention from the RBI

and the Government. The two institutions need to keep aside their differences

and work on this issue together to get back the economy to its normal form.

Even though the growth rate in India is quite good, it wavered a little in 2018

and was lower as compared to the previous years. There are many reasons for the

same however the NBFC crisis was a major contributor in the same.

REFERENCES-

Menon, S. (2019). Panic selloff in stock market after IL&FS crisis: Is the NBFC party over? Retrieved

From https://economictimes.indiatimes.com/markets/stocks/news/panic-selloff-in-stock-market-after-ilfs-crisis-is-the-nbfc-party-over/articleshow/66230674.cms [Accessed 1 July 2019].

RBI. (2018). Non-banking financial institutions. Retrieved from

https://m.rbi.org.in/Scripts/PublicationsView.aspx?id=18745#C67 [Accessed 1 July 2019].

Gopakumar, G. (2019). NBFC crisis not a solvency issue, says industry body. Retrieved from

https://www.livemint.com/industry/banking/nbfc-crisis-not-a-solvency-issue-says–1562086535122.html [Accessed 2 July 2019].

moharkan, F. (2019). DH Deciphers | Is there crisis in NBFC sector?. Retrieved from

https://www.deccanherald.com/business/business-news/dh-deciphers-is-there-crisis-in-nbfc-sector-734084.html [Accessed 2 July 2019].

Online, F. (2019, March 14). Impact of NBFC crisis on real estate sector in India. Retrieved from

https://www.financialexpress.com/money/impact-of-nbfc-crisis-on-real-estate-sector-in-india/1516056/ [Accessed 3 July 2019]

Well done in the research. Great choice of topic.

The blog is very informative

LikeLike

Great efforts!

LikeLike

Amazing! Great work.

LikeLike

It was very interesting!

LikeLike

The article is informative … You could have used more examples of other problems with NBFCs like indiabulls, DHFL etc….. Creates interest in the article… But good job.

LikeLike

amazing!

LikeLike

Great blog. Really great insight on the issue and good suggestions.

LikeLike

Great insights!

LikeLike

this is so informative and interesting!

LikeLike

Very nice article. I actually feel that you have done justice to the issue of crisis in NBFC & the example of IFLS was to bring the issue to fore.

Please see the budget presented on 05.07.19 in which specific steps have been taken to support & regulate nbfcs. Some of these are as suggested in your article: special liquidity window for nbfc, stringent measures by RBI as regulator, suggested merger of two regulators in RBI for both HFC & NBFC, credit guarantee scheme for banks for purchase of assets from NBFC etc.

LikeLike

Good article.

LikeLike

Really insightful and very well researched. Great work

LikeLike

Very insightful and great research

LikeLike

Very well written!

LikeLike